Location Intelligence for Modern Workforce Compliance

Monaeo helps individuals and organizations track travel and remote work activity in real time, making it easy to spot tax, payroll, and compliance risks early.

Key Services

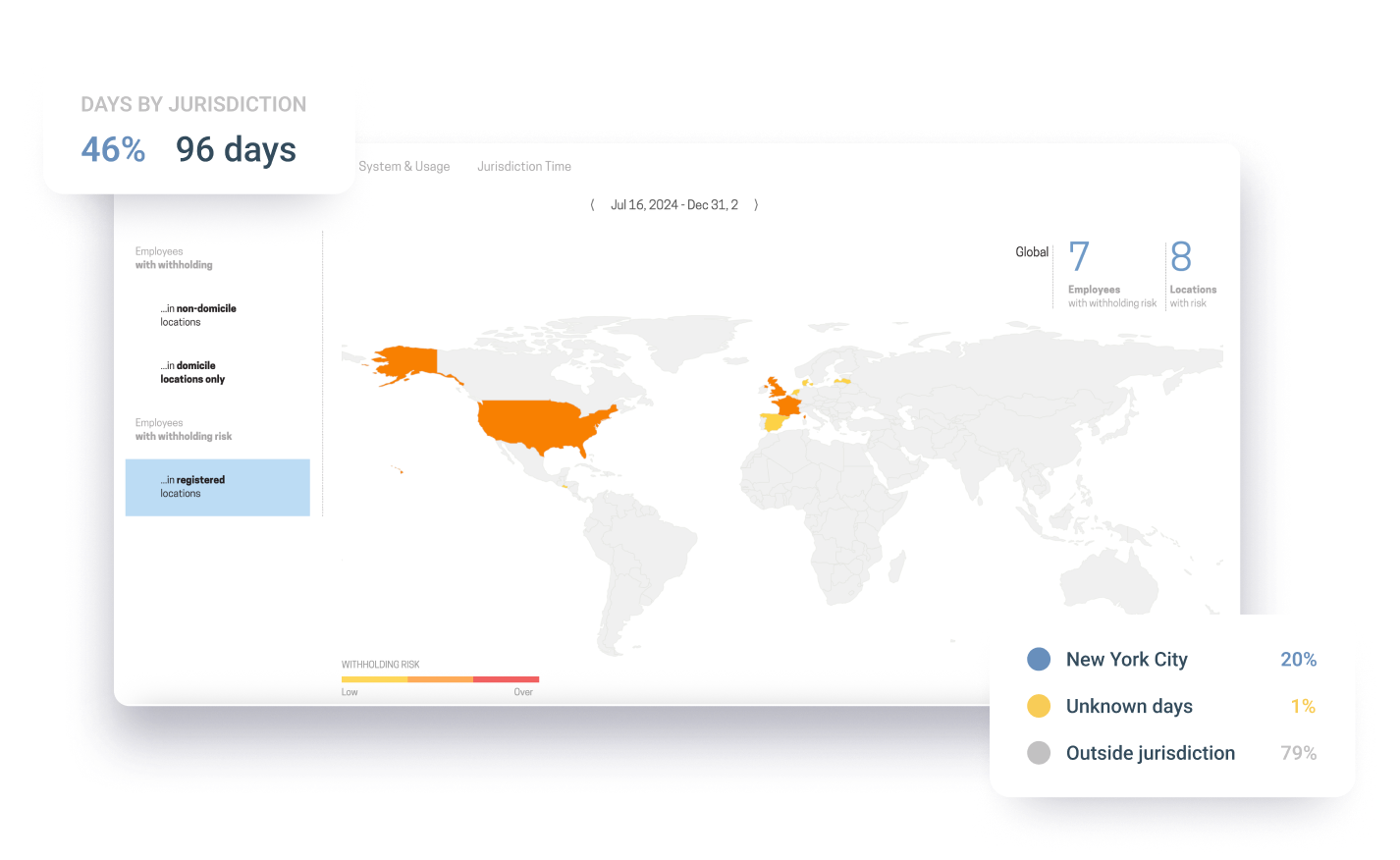

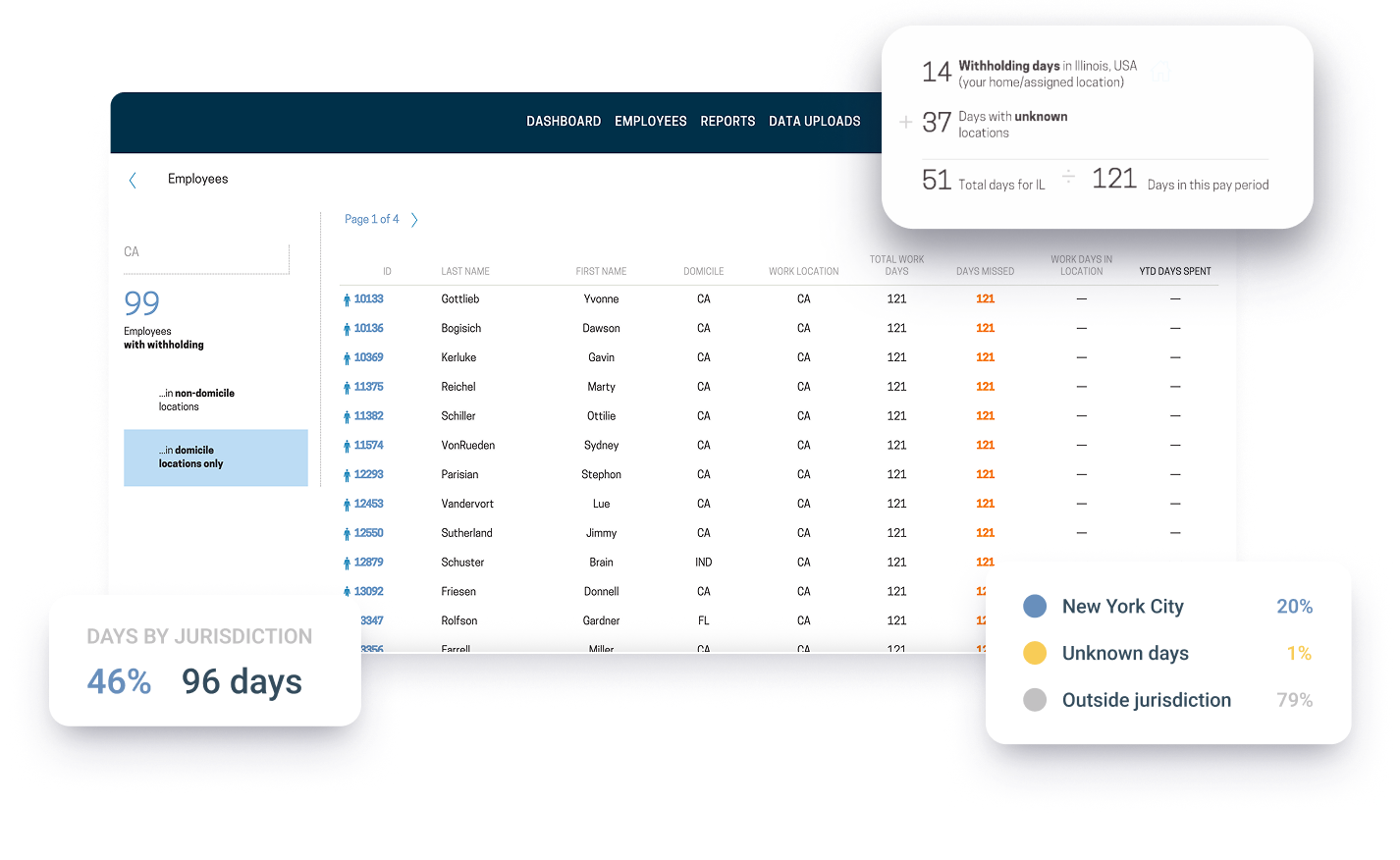

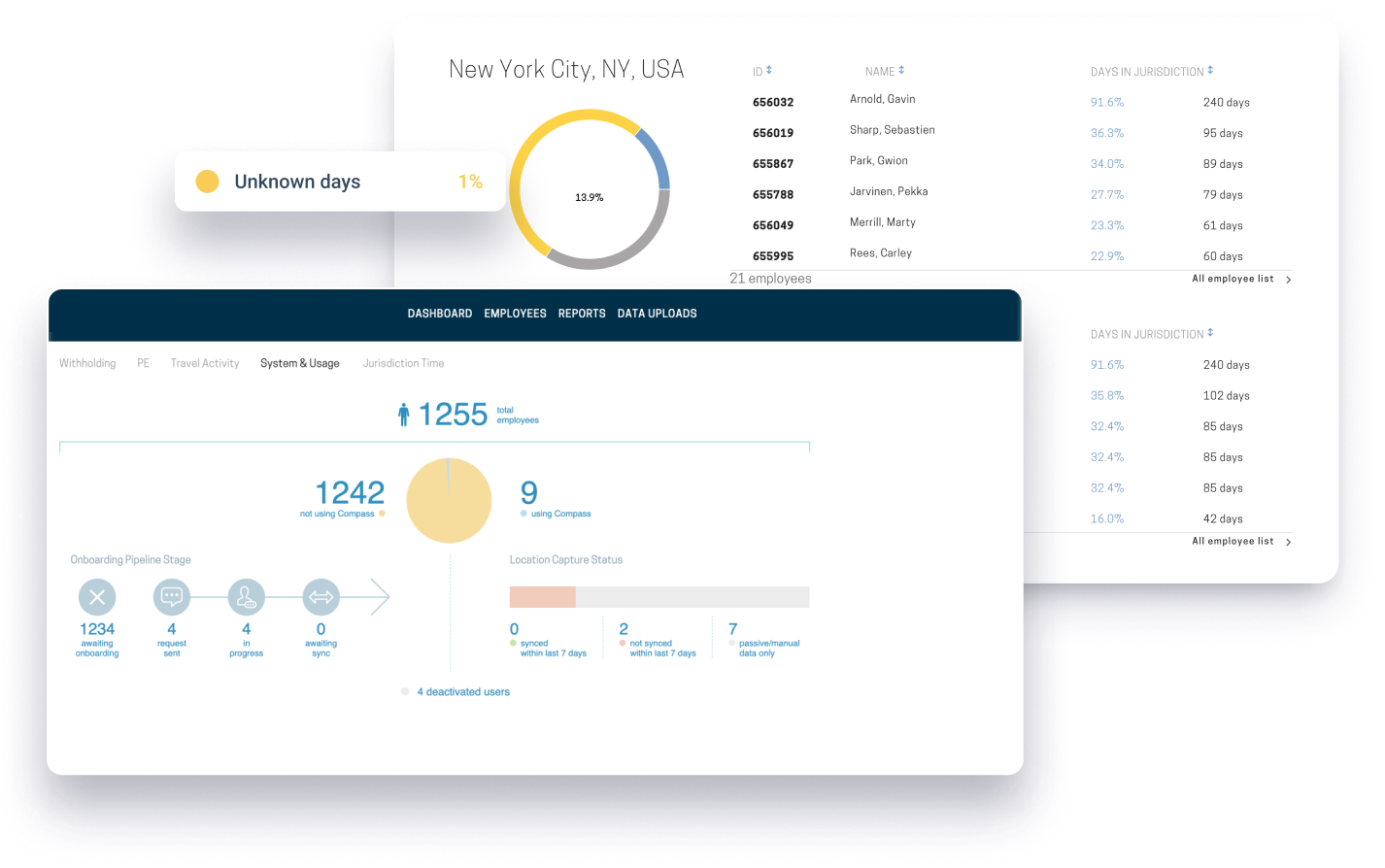

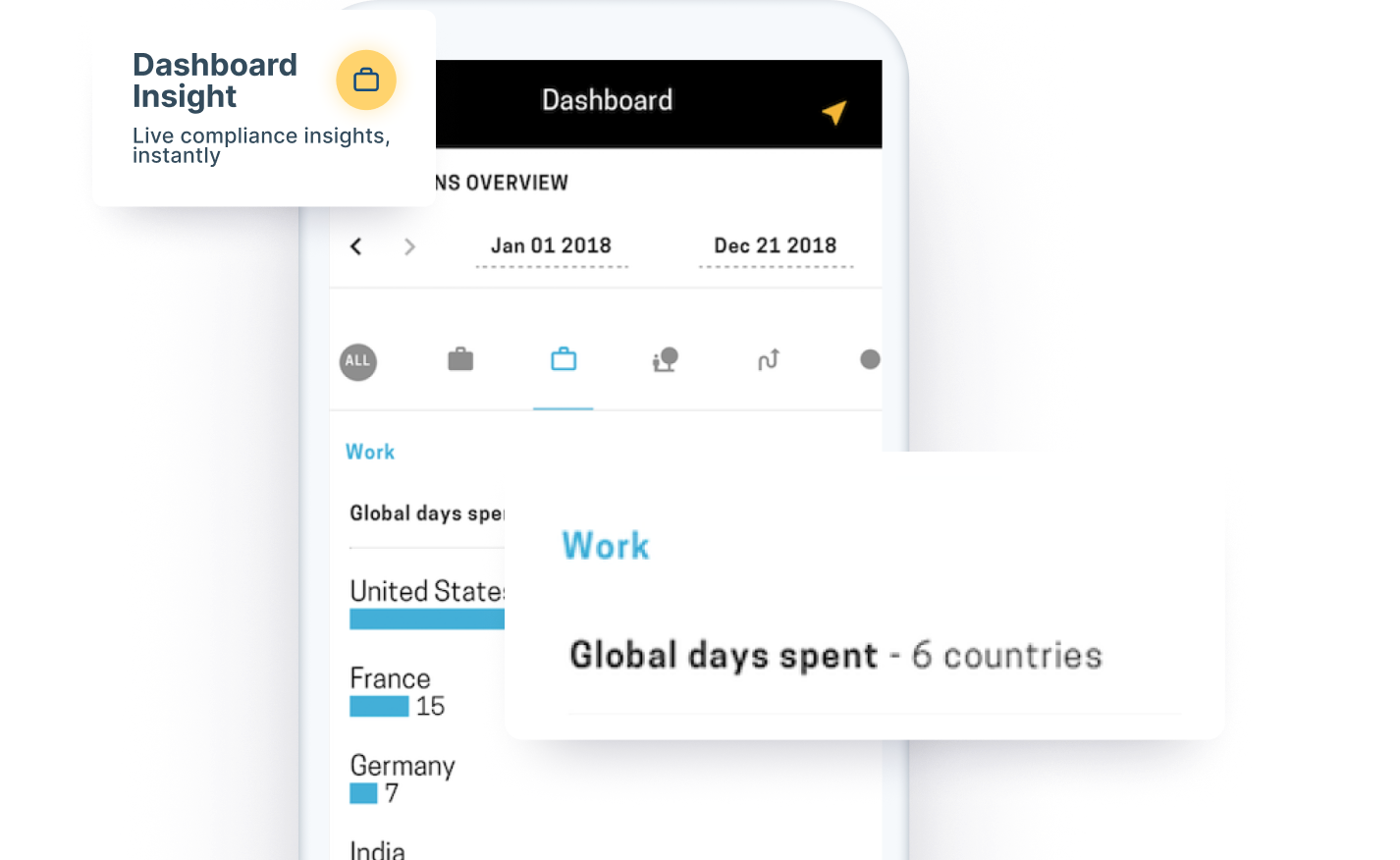

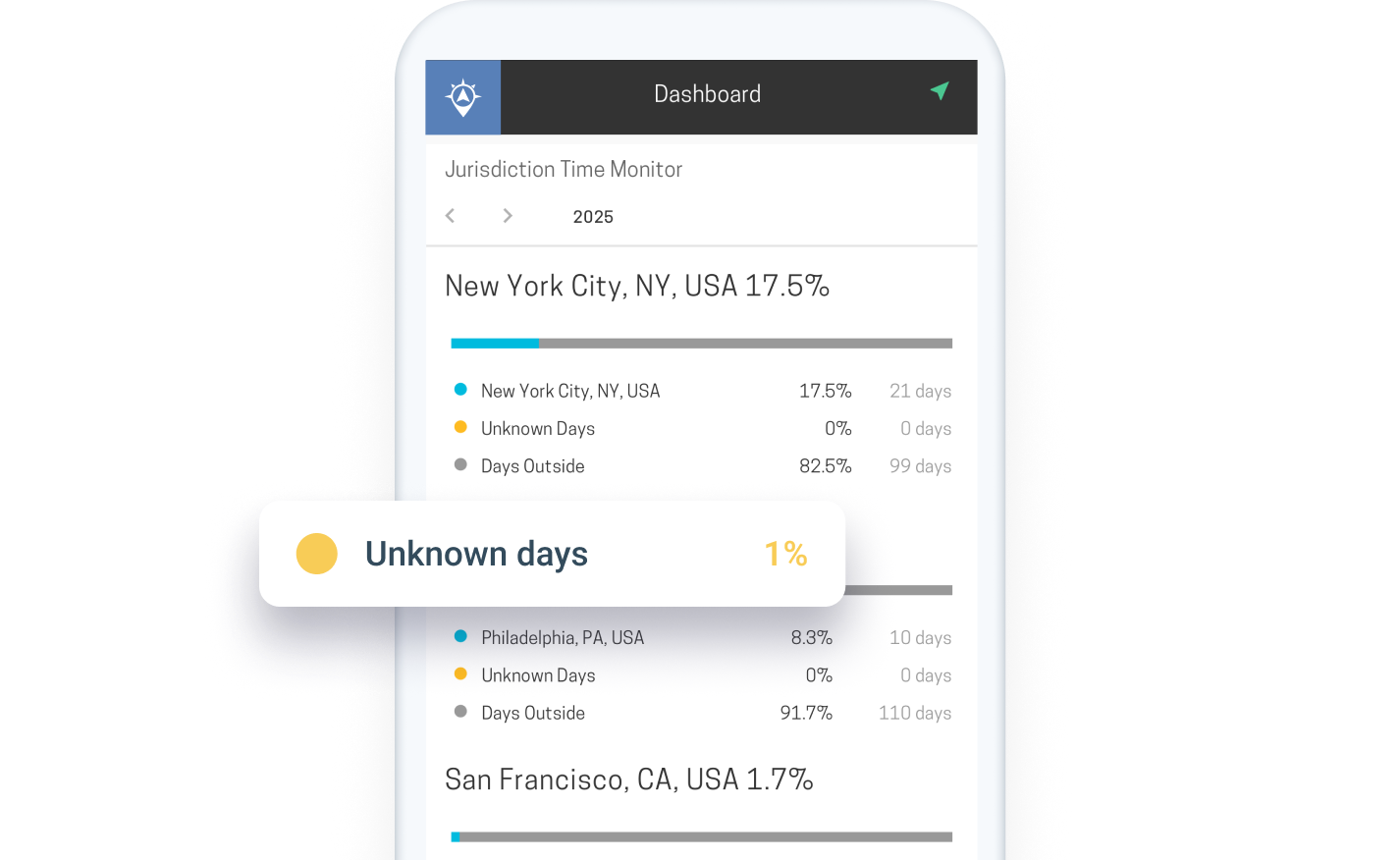

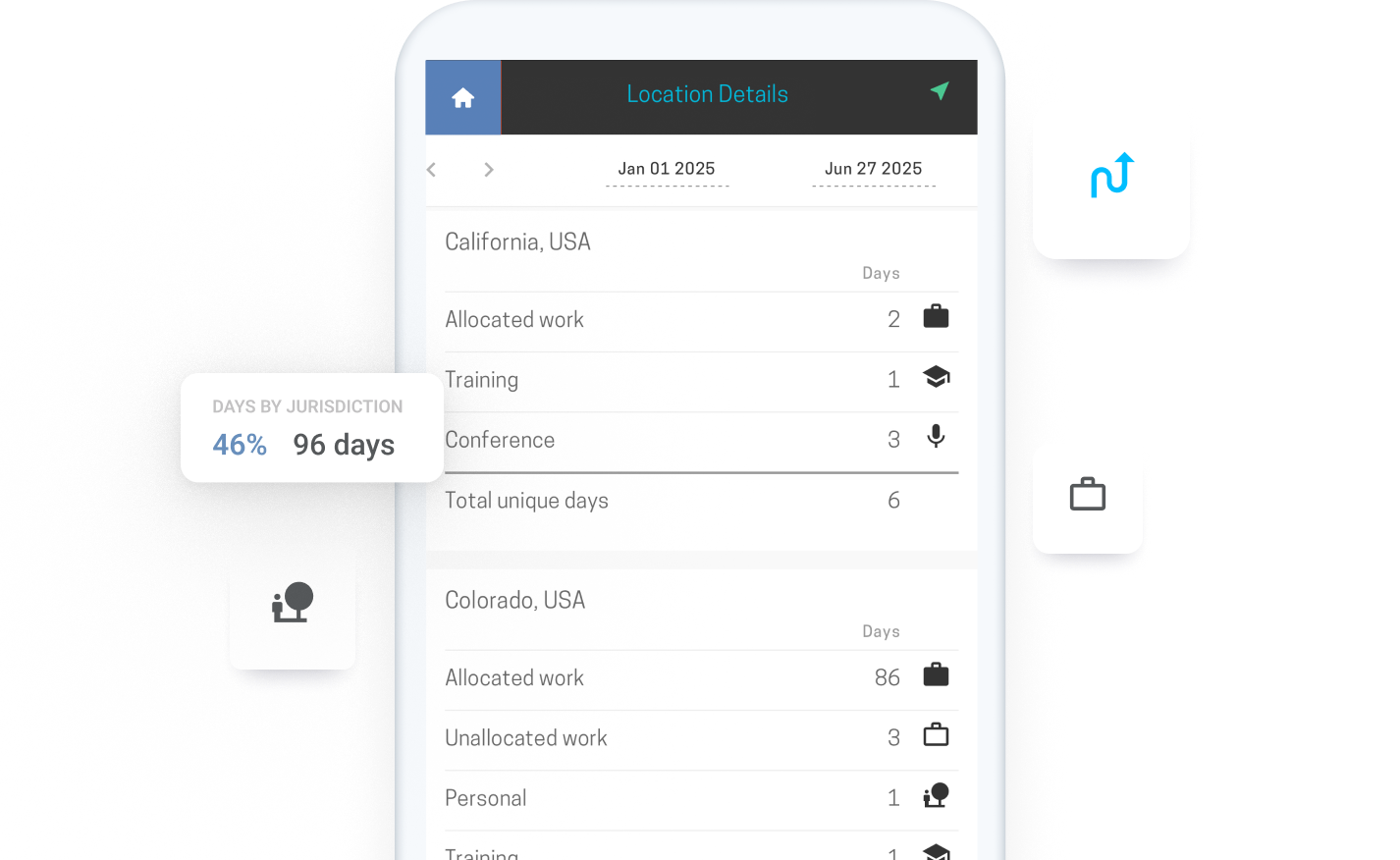

Reporting on City Jurisdiction Data

Track days in high-tax cities like NYC (New York City) and SF (San Francisco) to prove work locations, avoid overpaying, and stay compliant. No spreadsheets needed.

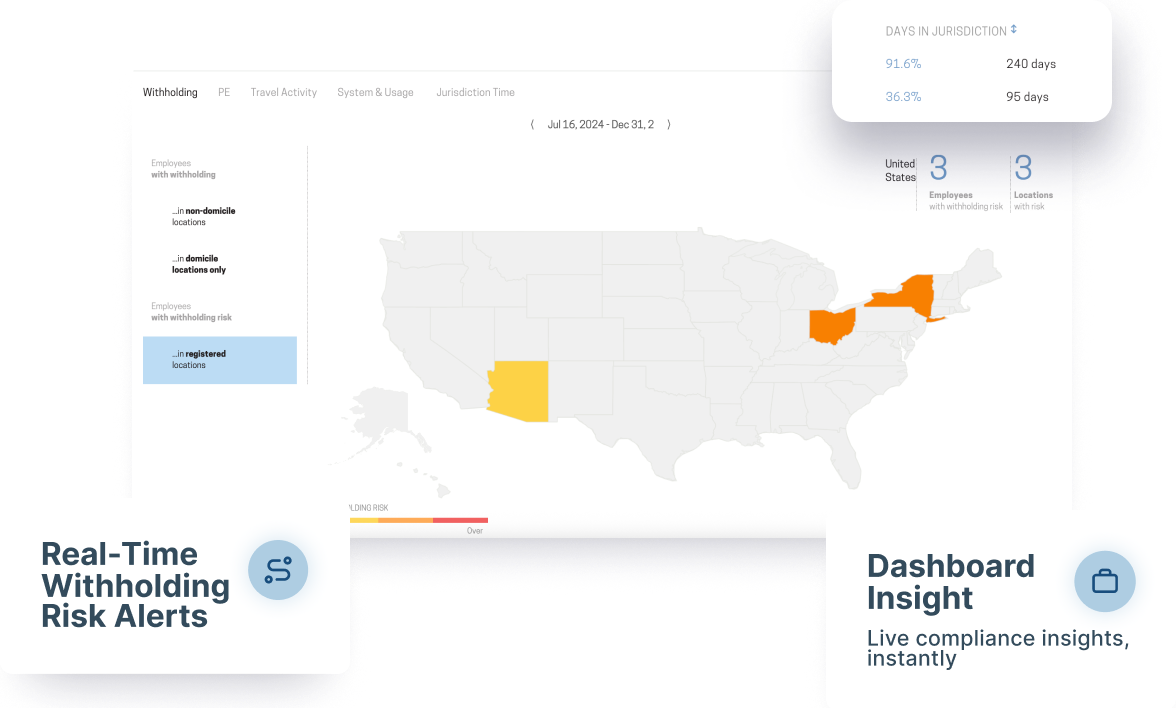

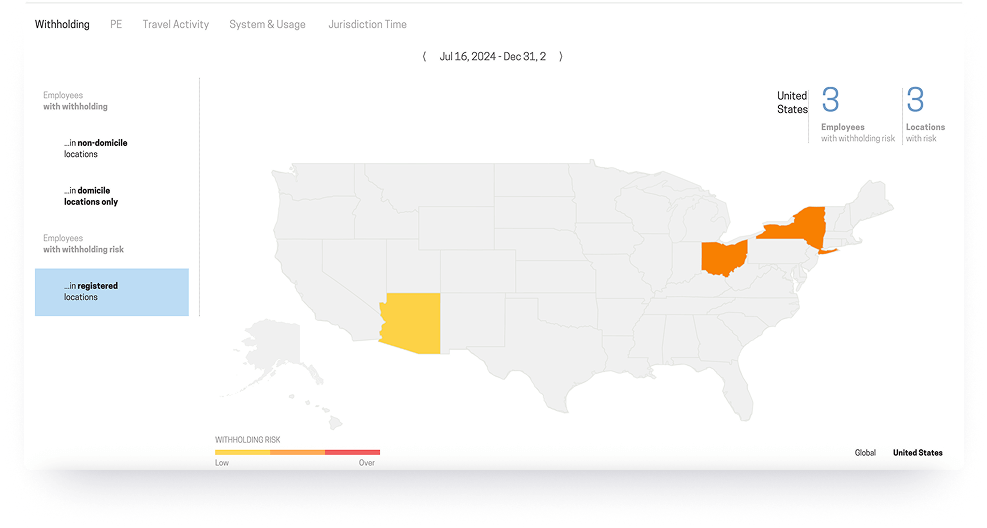

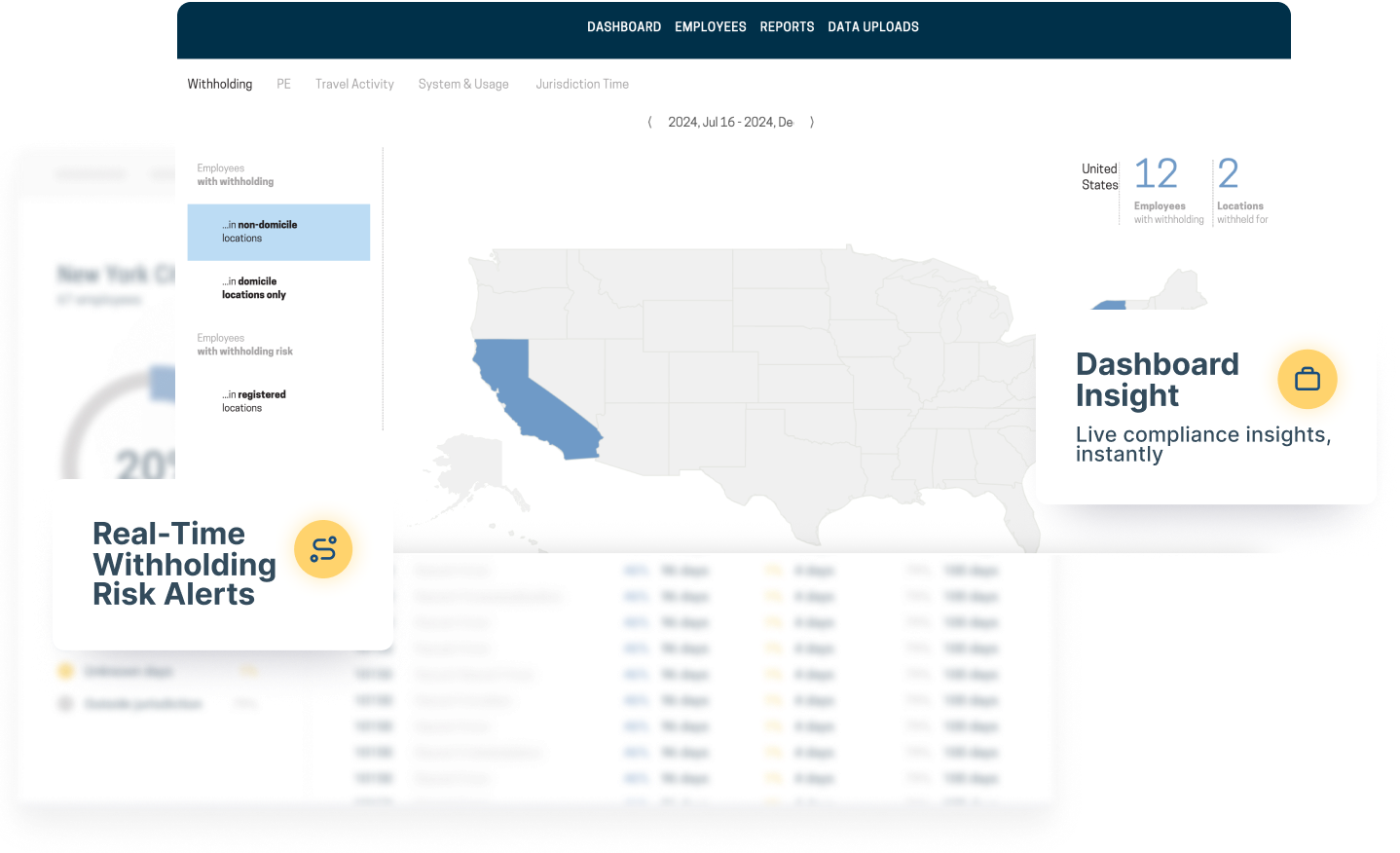

Domestic and International Payroll Withholding

Avoid payroll errors across borders. Monaeo tracks movement and flags tax triggers in real-time to keep you compliant from everywhere your people log in.

Permanent Establishment

Monitor cross-border activity to catch PE (Permanent Establishment) risks early, avoid surprise taxes, and simplify reporting for tax and finance teams.

Schengen Compliance Tracking

Automatically track Schengen days to stay within the 90/180-day rule and avoid visa issues or penalties.

- For Enterprise

- For Individuals

- For Enterprise

- For Individuals

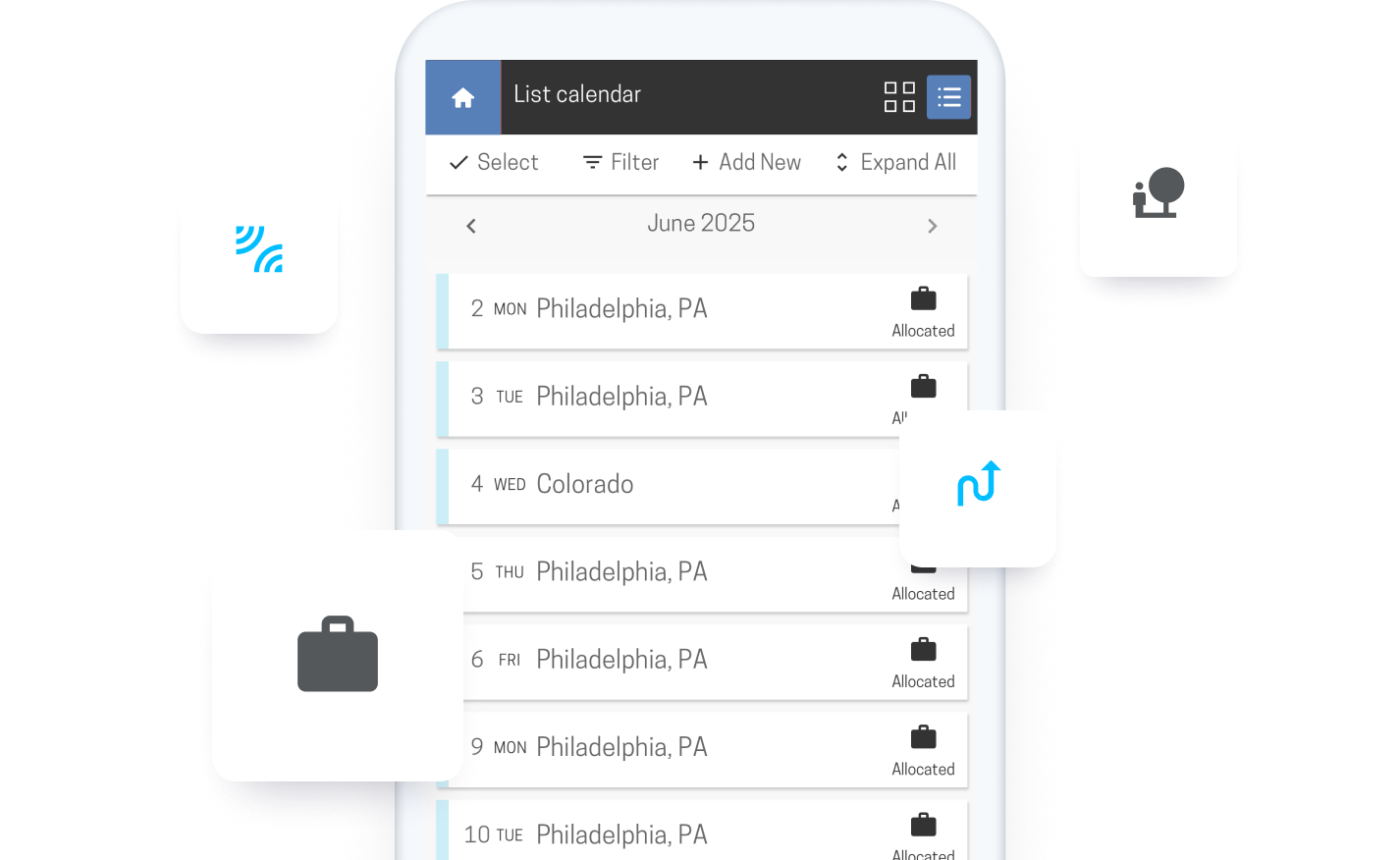

Proactively Manage Compliance Issues Created by Employee Movement

Whether your team is working remotely, traveling for business, or blending both, Monaeo gives you real-time visibility into cross-border movement. Automatically track state-to-state and international travel to flag tax, payroll, and permanent establishment risks before they become costly issues. Simplify reporting, reduce audit exposure, and support global mobility compliance without disrupting the employee experience

Learn More

Strengthen Your Tax Position with Verified Location Data

Remote work, frequent travel, and blended living arrangements can make tax compliance a minefield. Monaeo automatically monitors your location and builds audit-ready reports, accepted in hundreds of audits and developed in partnership with SALT (state and local tax) law experts, so you can stay compliant with confidence.

Learn More

Trusted by Millions of Global Users

“I have used the Monaeo product for close to four years and found it to be a critical tool for accurately tracking my day count in different geographies. The Monaeo dashboard is graphically easy to understand and is extremely reliable. Monaeo was very helpful in verifying my physical presence. I highly recommend this tool for anyone seeking to keep accurate tracking information of their travels.”

Robert

Retired Executive of Fortune 500 Company

“Tax-savvy companies can potentially avoid millions in overpaid tax related to over-reporting compensation for work done outside of large city limits. A technology platform that can identify work location with a high degree of accuracy combined with advanced taxation and domain knowledge can be a powerful combination to substantiate tax reductions.”

Matthew Melinson

Partner, Grant Thornton

“Monaeo has been excellent and completely served my needs. I have successfully finished a NY State audit and have changed my primary domicile. I thank you for the 3+ years of fantastic service. It was helpful in my audit.”

Jeff

President, Publicly Traded Hospitality Company

“The adoption of remote work can significantly impact taxes owed by individuals and organizations based in the Philadelphia area. Taxpayers can realize substantial tax savings by identifying work performed outside of the city limits. Technology-based solutions can help organizations do this at scale and provide audit protection.”

Matthew Melinson

Partner, Grant Thornton